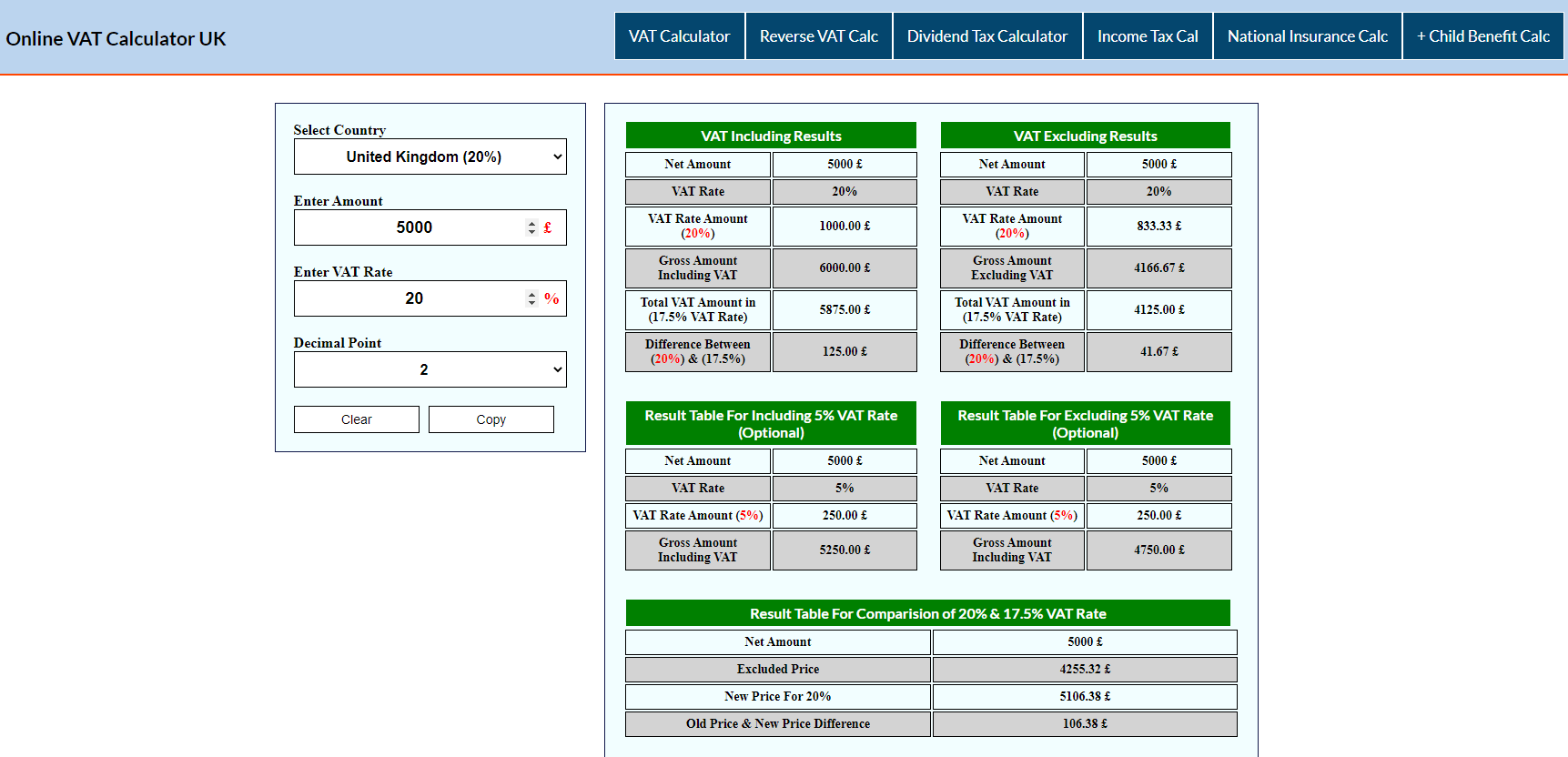

| Net Amount | |

|---|---|

| VAT Rate | |

| VAT Rate Amount () | |

| Gross Amount Including VAT | |

| Total VAT Amount in (17.5% VAT Rate) | |

| Difference Between () & (17.5%) |

| Net Amount | |

|---|---|

| VAT Rate | |

| VAT Rate Amount () | |

| Gross Amount Excluding VAT | |

| Total VAT Amount in (17.5% VAT Rate) | |

| Difference Between () & (17.5%) |

| Net Amount | |

|---|---|

| VAT Rate | |

| VAT Rate Amount () | |

| Gross Amount Including VAT |

| Net Amount | |

|---|---|

| VAT Rate | |

| VAT Rate Amount () | |

| Gross Amount Including VAT |

| Net Amount | |

|---|---|

| Excluded Price | |

| New Price For 20% | |

| Old Price & New Price Difference |

VAT Calculator

In This Most Accurate And Full Of Features VAT Calculator, You Can Easily Calculate Your VAT Rate. At Once You Will Have Multiple Results. VAT Rate In United Kingdom Is Now 20% And Didn't Change For Many Time. In Result Section Our Calculator Calculates a VAT Rate Of 20% And Also This Calculator Giving You a Difference Between 17.5%, And 20% With a 5% Reduced Rate Result. So You Don't Need To Select VAT Rate Again And Again This Tool Will Save Your Time Too Much Because At The Same Time You Will Have VAT Including Result And VAT Excluding Result in Infront Of You. Also, You Can Select Multiple Currencies And Countries For Your Calculation. For The United Kingdom Users, We Have Giving All Related Calculators As Well So You Don't Need To Go To Other Tools At Once Place All The Related Calculators Will Help You.

How To Calculate VAT? Value-Added TAX

Step One: VAT Rate + 100

Step Two: (Total Amount / 100) * Step 1

Example: 20 + 100 = 120

(1000 / 100) * 120 = 1200 Gross Total Amount

This Figure ( 1200 ) Is your Total Gross Amount With a Tax Rate of 20%.

In this Calculation :

Net Amount: 1000

Tax Rate: 20%

Tax Amount: 200

Total Gross Amount: 1200

Excluding VAT Formula

Price/Amount = Step One: VAT Rate + 100

Step Two: (Total Amount / Step 1) * 100

Example: 15 + 100 = 115

(1200 / 115) * 100 = 1043.48 Gross Amount

The Result ( 1043.48 ) Is the Total Gross Amount With The 15% tax rate.

In this Example :

Your Net Amount: 1200

Tax Rate: 15%

Tax Amount: 156.52

Your Gross Amount: 1043.48

The Standard VAT Rate In the UK Is Now 20%

The VAT Rate In The UK Suddenly Increased To 20% From 17.5% This Happened On 4 January 2011. In This Tool, We Have Added Both Results For You Once You Enter Your Amount It Will Differentiate Your Given Amount Between 17.5% And 20% And Will Give You The Idea That What Was The TAX Amount In the 17.5% VAT Rate.

HMRCValue Added Tax get by Her Majesty's Revenue and Customs (HMRC) From businesses that are Fully VAT registered In the United Kingdom(UK). HMRC Is Responsible for collecting taxes After registration. Every company Has its own VAT number. Which Was Increased Almost From 17.50 % in 2011. And 5% Reduced Rate Is On Multiples Goods And Services. And Zero VAT Rate Is Also On Multiple Services And Products.

All VAT Rates In Europe

VAT Rates By Countries